All Categories

Featured

Table of Contents

Any guarantees supplied are backed by the financial stamina of the insurer, not an outside entity. Investors are warned to carefully assess an indexed annuity for its features, expenses, threats, and just how the variables are computed. A set annuity is intended for retirement or various other long-lasting demands. It is meant for a person who has adequate cash money or various other fluid assets for living costs and various other unforeseen emergencies, such as clinical expenditures.

Please think about the investment purposes, threats, charges, and expenses very carefully before buying Variable Annuities. The prospectus, which includes this and other information concerning the variable annuity agreement and the underlying financial investment options, can be acquired from the insurer or your financial expert. Make certain to review the syllabus very carefully before choosing whether to spend.

Variable annuity sub-accounts vary with adjustments in market conditions. The principal might be worth essentially than the original quantity invested when the annuity is surrendered.

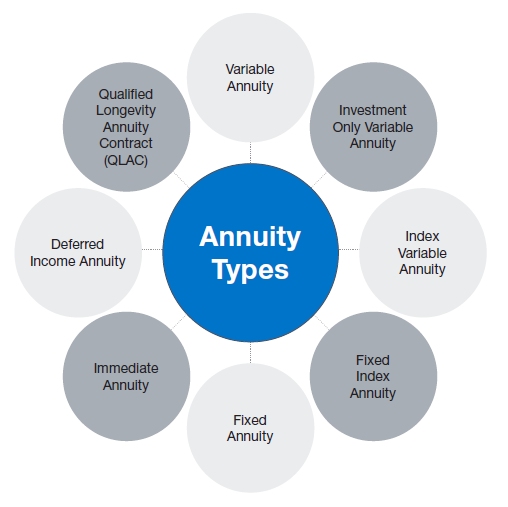

Trying to choose whether an annuity could fit into your financial strategy? Comprehending the different offered annuity choices can be a useful means to start.

In exchange for the initial or recurring superior payment, the insurance provider commits to certain terms set in the contract. The simplest of these contracts is the insurer's dedication to giving you with payments, which can be structured on a regular monthly, quarterly, semi-annual or yearly basis. Conversely, you might select to bypass repayments and permit the annuity to grow tax-deferred, or leave a round figure to a beneficiary.

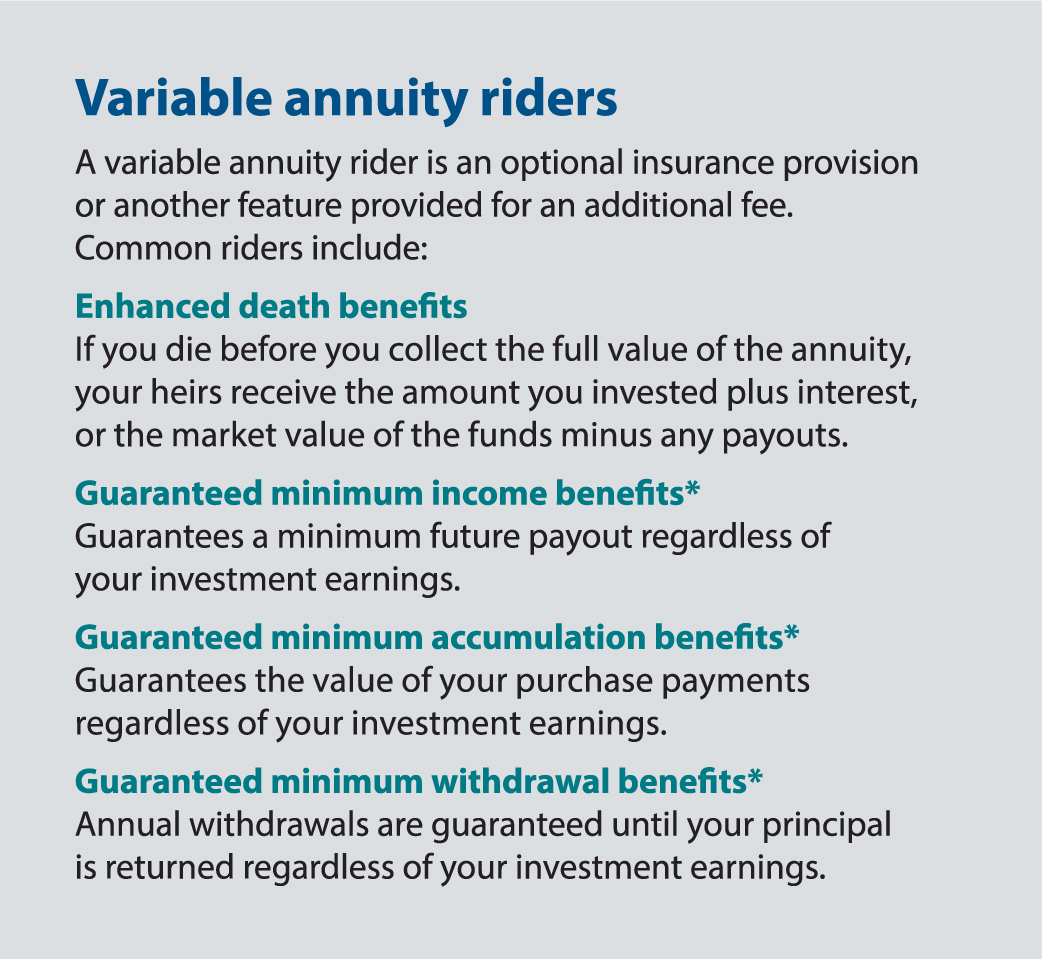

There likewise could be optional attributes (motorcyclists) available to you, such as a boosted death advantage or long-lasting care. These provisions commonly have actually added charges and costs. Relying on when they pay, annuities come under 2 primary groups: immediate and delayed. Immediate annuities can offer you a stream of revenue right away.

Exploring the Basics of Retirement Options Key Insights on Variable Vs Fixed Annuity What Is Fixed Interest Annuity Vs Variable Investment Annuity? Advantages and Disadvantages of Different Retirement Plans Why Choosing the Right Financial Strategy Is a Smart Choice Fixed Income Annuity Vs Variable Growth Annuity: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Fixed Vs Variable Annuity Pros And Cons Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Immediate Fixed Annuity Vs Variable Annuity A Beginner’s Guide to Retirement Income Fixed Vs Variable Annuity A Closer Look at How to Build a Retirement Plan

When you can pay for to wait for a while to obtain your payout, a deferred annuity might be a good selection for you. Immediate annuities can offer a regular stream of ensured payments that can be structured for the rest of your life. They might even refund any remaining settlements that have not been made in case of premature death.

With instant annuities, there are different kinds of settlement alternatives. A life payout provides a repayment for your lifetime (and for your spouse's life time, if the insurance coverage company supplies a product with this option). Duration certain annuities are simply as their name indicates a payment for a set amount of years (e.g., 10 or 20 years).

In addition, there's occasionally a reimbursement option, a function that will pay your recipients any kind of leftover that hasn't been paid from the initial costs. Immediate annuities usually use the greatest settlements contrasted to various other annuities and can assist deal with a prompt income requirement. However, there's always the possibility they might not stay on top of inflation, or that the annuity's recipient may not receive the staying equilibrium if the owner selects the life payout option and after that passes away too soon.

Exploring What Is A Variable Annuity Vs A Fixed Annuity A Comprehensive Guide to Annuities Variable Vs Fixed What Is Fixed Vs Variable Annuity Pros Cons? Pros and Cons of Retirement Income Fixed Vs Variable Annuity Why Choosing the Right Financial Strategy Is Worth Considering How to Compare Different Investment Plans: Simplified Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing Tax Benefits Of Fixed Vs Variable Annuities FAQs About Fixed Index Annuity Vs Variable Annuity Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

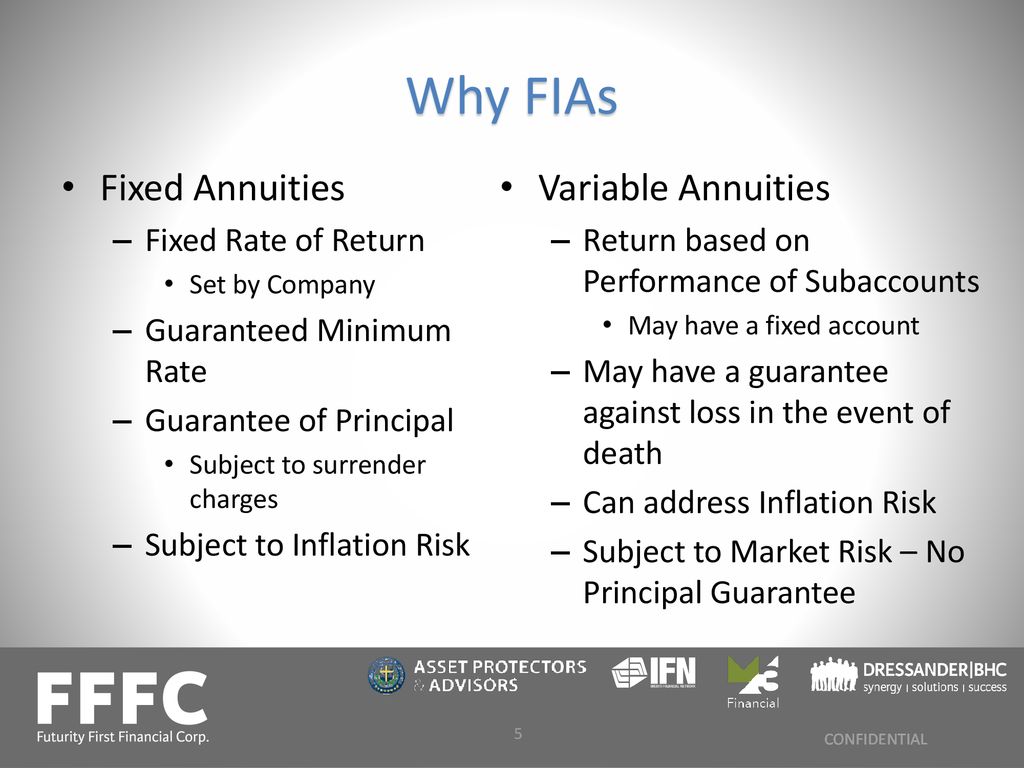

Taken care of, variable and fixed indexed annuities all accumulate rate of interest in different means. Nevertheless, all 3 of these annuity types typically provide withdrawals, systematic withdrawals and/or can be established up with an assured stream of earnings. Possibly the most convenient to recognize, fixed annuities help you expand your money because they provide a set rates of interest (assured price of return) over a set period of years.

Passion earned is intensified and can be left in the annuity to remain to expand or can be taken out after the agreement is annuitized (or potentially during the contract, depending upon the insurance coverage firm). Once the dealt with annuity contract is initiated, the insurance policy firm can not change its passion. However, the rates of interest used might not stay up to date with rising cost of living, and you are committed to them for the set period despite economic changes.

Relying on the efficiency of the annuity's subaccount choices, you might receive a greater payout as an outcome of that market direct exposure; that's because you're also risking the contributed balance, so there's additionally an opportunity of loss. With a variable annuity, you obtain all of the rate of interest credited from the spent subaccount.

And also, they may likewise pay a minimal surefire rates of interest, despite what occurs in the index. Payments for fixed indexed annuities can be structured as ensured regular settlements simply like other sort of annuities, and rate of interest depends on the regards to your agreement and the index to which the cash is connected.

Just taken care of indexed annuities have a move day, which notes the day when you initially begin to take part in the index allotment's efficiency. The move day differs by insurance firm, yet generally insurance providers will assign the funds in between one and 22 days after the preliminary investment. With taken care of indexed annuities, the crediting duration starts on the sweep day and commonly lasts from one to 3 years, depending on what you select.

For younger people, an advantage of annuities is that they provide a means to start getting ready for retirement beforehand. With an understanding of just how annuities work, you'll be much better furnished to select the right annuity for your demands and you'll have a much better understanding of what you can likely expect along the method.

Breaking Down Your Investment Choices A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Features of Variable Annuity Vs Fixed Indexed Annuity Why Choosing the Right Financial Strategy Can Impact Your Future Indexed Annuity Vs Fixed Annuity: How It Works Key Differences Between Different Financial Strategies Understanding the Rewards of Fixed Index Annuity Vs Variable Annuities Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Vs Variable Annuity Pros Cons FAQs About Variable Annuity Vs Fixed Annuity Common Mistakes to Avoid When Choosing Fixed Interest Annuity Vs Variable Investment Annuity Financial Planning Simplified: Understanding What Is A Variable Annuity Vs A Fixed Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at Fixed Income Annuity Vs Variable Growth Annuity

A fixed annuity is a tax-advantaged retired life savings option that can assist to assist build foreseeable possessions while you're working. After you determine to retire, it can produce an ensured stream of earnings that could last for the remainder of your life. If those benefits appeal to you, keep reading to find out even more about: Just how fixed annuities workBenefits and drawbacksHow taken care of annuities contrast to other kinds of annuities A fixed annuity is a contract with an insurance policy company that is comparable in numerous ways to a bank certification of deposit.

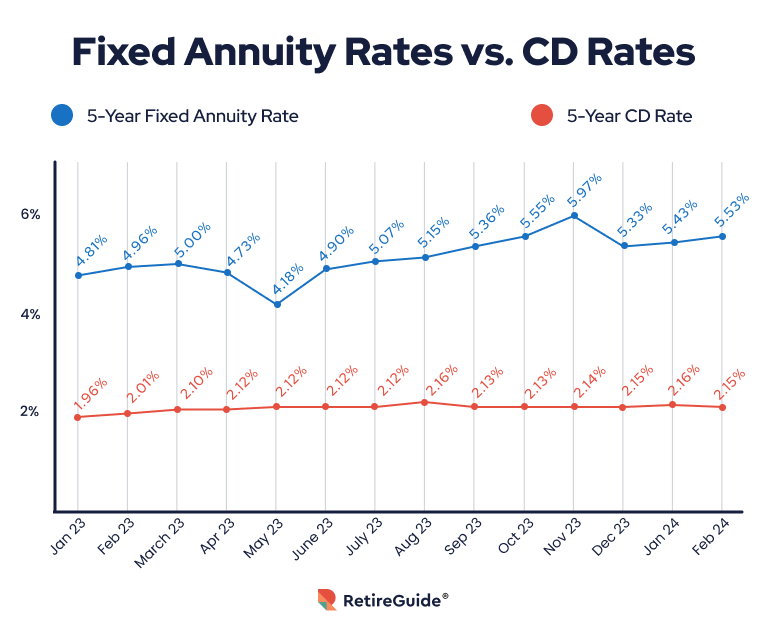

Usually, the price of return is guaranteed for several years, such as 5 years. After the initial guaranteed duration, the insurance provider will certainly reset the interest rate at regular periods normally each year but the brand-new rate can not be reduced than the assured minimum interest price in the contract.

You don't always need to transform a dealt with annuity into normal income settlements in retirement. You can choose not to annuitize and get the entire value of the annuity in one lump-sum settlement. Dealt with annuity contracts and terms vary by supplier, but various other payment alternatives generally include: Duration certain: You get normal (e.g., month-to-month or quarterly) ensured repayments for a set time period, such as 10 or twenty years.

Intensified development: All rate of interest that continues to be in the annuity additionally earns passion. Guaranteed revenue: After the very first year, you can convert the quantity in the annuity right into an assured stream of set earnings for a specific duration of time or also for the rest of your life if you select.

Latest Posts

Commuted Value Of Annuity

Allianz Variable Annuities

Equitable Annuities